How I Became a Venture Capitalist

Becoming a venture capitalist is a very weird story for almost everybody. It’s a rare subset of finance where people stumble into it rather than taking a well trodden, planned path, for the most part. That was true for me.

My investing career started in earnest when I discovered AngelList in 2015. I started to invest small checks into SPVs, got obsessed with researching and finding new companies myself, and decided that I should be the one leading the SPVs.So I launched a few SPVs on AngelList, and suddenly I was considered to be an investor. My operator profile was growing quickly too - at this point, I was also leading revenue at Tinder as it became the top-grossing app in the world. A few of my SPVs started to do well, and I was building my brand online primarily through sharing a bunch of random things on Twitter. Index Ventures asked me to become a scout.

I was flattered because my 19 other peers in the program were really incredible operators, including Dylan Field from Figma. I knew that I had to take this seriously if I ever wanted to become a venture capitalist, and so I became pretty competitive about the entire thing and presenting like a professionalised venture firm. I created a firm name, which was Chapter One, did a little bit of branding work, and launched a website. I also developed a thesis and began to publish my investing ideas online.

It paid off because people started to look at me as being more than just an operator. I was still at Tinder but some even saw me as being an investor first. My scout program portfolio at Index Ventures was very successful. I invested in the seed round of Mercury and was also a seed investor in projects like The Graph.

The fund was marked at a 14x MOIC (multiple on invested capital) with 4x DPI (distributed to paid in) in 3 years — easily one of the the top performing funds in the program. Those results mattered because they proved to LPs that I could actually do this when it came time to raise capital for Chapter One.

I’ve always thought of that scout program as the moment I became an investor. It took me from operator-who-angel-invests to someone with a real portfolio and a real track record. And ever since, I've been thinking about what was missing from the experience, and how to build on it. The path from operator to investor is opaque and exclusive and there needs to be a better way to surface investing talent.

Most scout programs have three problems:

1. Access is closed (you either know a GP who invites you, or you don’t)

2. Performance is hidden (scouts can’t build public track records or reputations)

3. The programs are designed to create leverage for firms, not for scouts.

That’s what we’re changing.

Today we’re launching Scout Program: www.scoutprogram.com.

The big twist is that we’re letting everybody apply. No GP invite required. We select 10 scouts each season from a global applicant pool, and each scout gets $100K in real capital to deploy into early-stage startups.

This is a season-based competition. Every scout creates a public profile with their own fund name, investment thesis, and real-time performance tracking - just like I did during my own scout days. There’s a live leaderboard that tracks value throughout the season.

Beyond deal performance, the leaderboard rewards the full picture — how you build your brand, how you run your back office, how you operate like a real firm. The top performer walks away with carry, a track record that speaks for itself, and a clear path to managing their own fund.

We also want to make this more social and give scouts a real platform to build their careers. Think of the profile as the best resume an aspiring investor could have by showcasing investments, thesis, and portfolio updates all in one place.

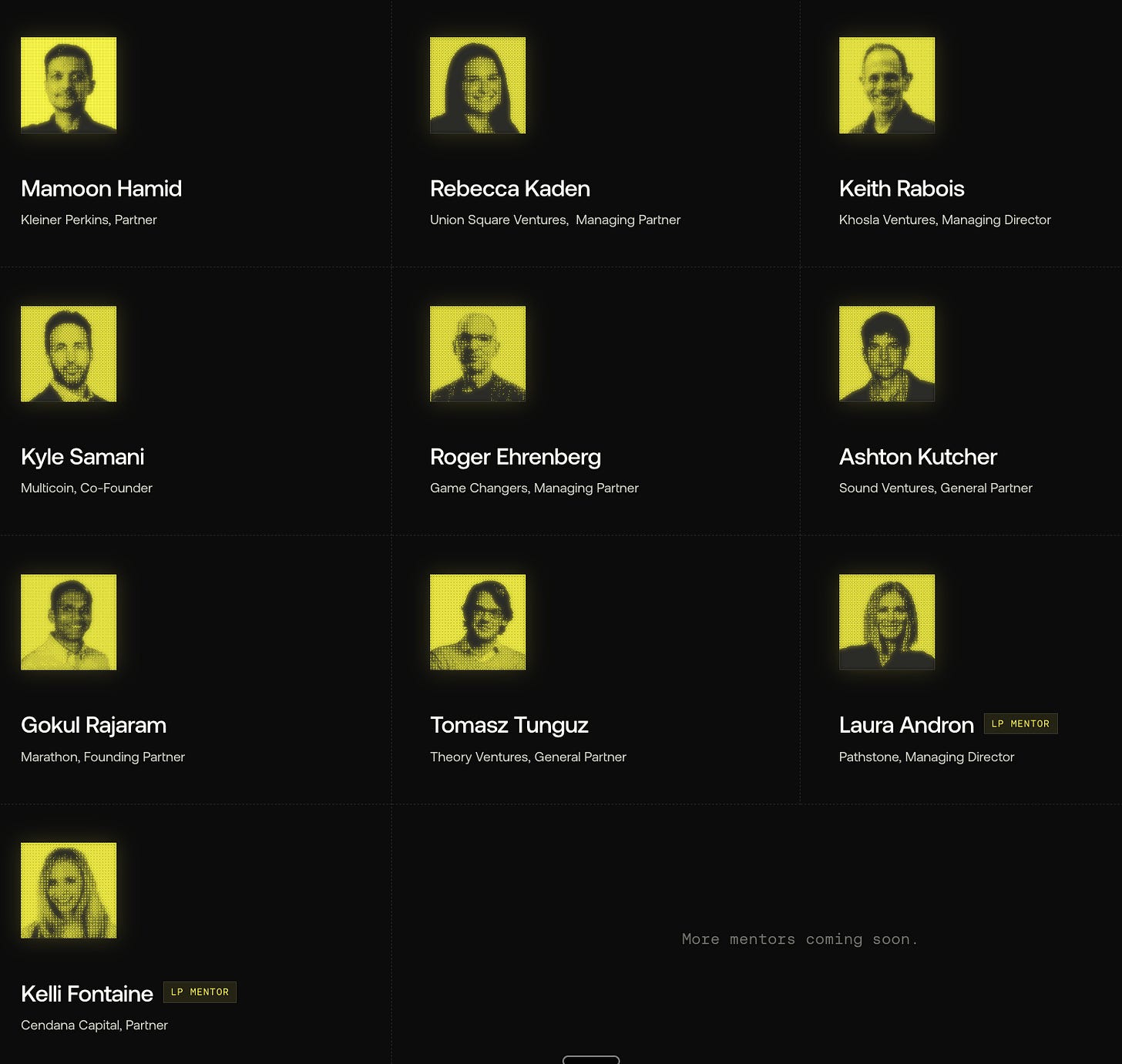

We’re surrounding our scouts with a world-class mentor group from firms like Khosla Ventures, Union Square Ventures, and Kleiner Perkins. We’ve brought together some of the most legendary investors in the business, and a group of LPs who can offer perspective on firm-building, for the scouts who ultimately want to go that route:

Mamoon Hamid, Partner at Kleiner Perkins

Keith Rabois, Managing Director at Khosla Ventures

Rebecca Kaden, Managing Partner at Union Square Ventures

Kyle Samani, Founder at Multicoin Capital

Roger Ehrenberg, Managing Partner at Game Changers

Gokul Rajaram, Founding Partner at Marathon

Tomasz Tunguz, General Partner at Theory Ventures

Ashton Kutcher, General Partner at Sound Ventures

Laura Andron, Managing Director at Pathstone

Kelli Fontaine, Partner at Cendana Capital

Season One kicks off March 14th, 2026. Applications are open now at www.scoutprogram.com.

Aspirationally, this is the Thiel Fellowship for investing. Let’s see if we can get there.